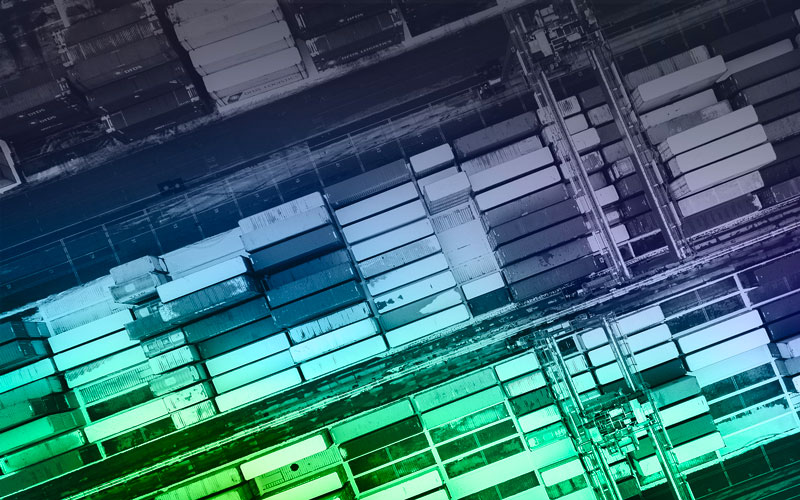

Cross-Border Factoring

✔ Without Credit Insurance

✔ 100% Advance Rates

Our mission

Reduce your risk and boost your cash flow with Originate Capital.

Traditional banks and factoring companies often finance only 80-90% of your invoice amounts, requiring insurance cover for your buyer.

At Originate Capital, we’ve eliminated these hurdles.

Enjoy a 100% advance rate on your invoices. We assume the credit risk, eliminating the need for credit insurance approval.

Benefit from our low-cost, flexible invoice finance solutions. With us, you’re shielded from invoice disputes and the risk of buyer defaults.

Our products

Working capital solutions.

Our offer to service your business’ needs.

Risk mitigation.

Originate Capital eliminates credit risk by serving as a trusted intermediary between buyers and sellers, covering potential payment shortfalls in case of default.

Additionally, we reduce the risk of invoice disputes by obtaining robust payment confirmations from your buyers.

Global trade.

We specialize in cross-border trades, enabling manufacturers and traders in emerging and frontier markets to receive immediate payment when selling to buyers in the USA and Europe.

Nothing kills more businesses than a lack of cashflow.

Use cases.

We work with companies big and small.

Garment Retailer

Due to the unavailability of credit insurance, an Indian supplier couldn’t secure factoring for one of its largest US buyers. Originate Capital extended a $1.25 million limit based solely on the buyer’s audited financials.

LME Copper Trader

An experienced metals trader, supplying several US publicly listed companies, required bridge financing to bridge the gap between paying suppliers and receiving payments from American importers.

Originate Capital directly paid the trader’s suppliers based on approved invoices from the importers.

Renewable Energy Contractor

An Indian exporter to the US encountered cash flow challenges.

In partnership with the American importer, Originate Capital discounted multiple 180-day invoices, ensuring the supplier had the liquidity needed to fulfill the importer’s purchase orders.

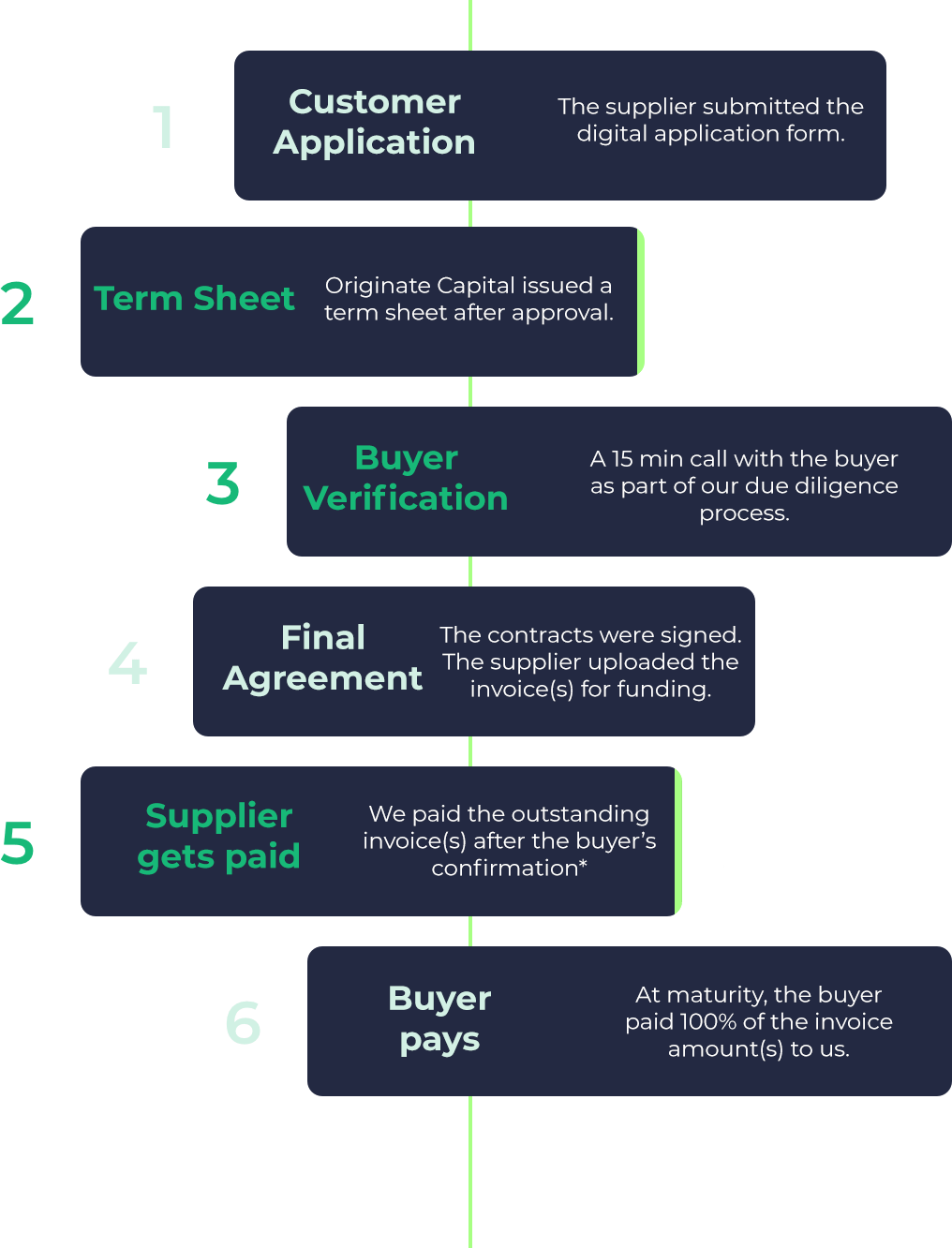

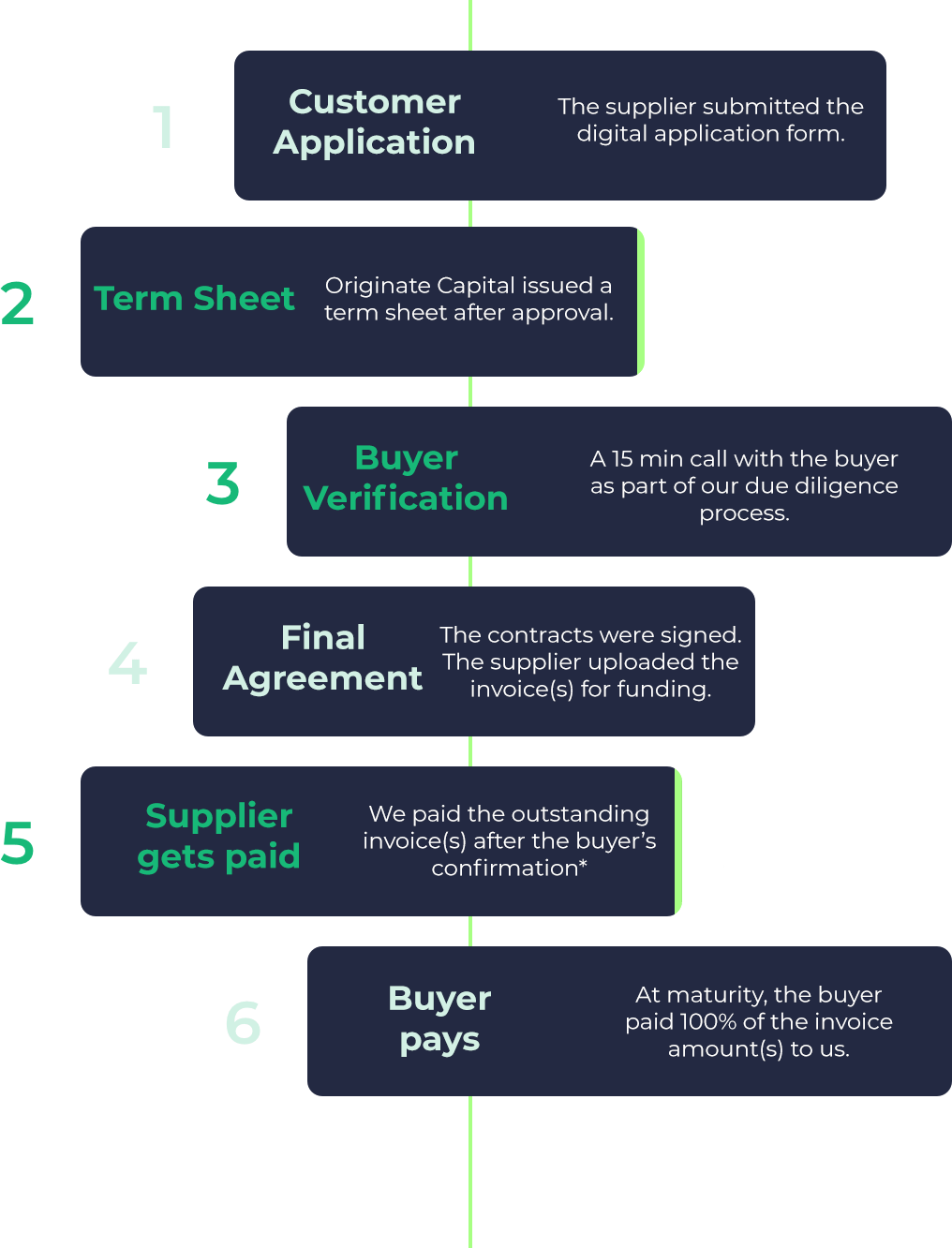

How it works

Transparency at its core.

A process you can relate to – fast, personalised and secure.

Further questions?

Connect with one of our team today.

Why us

You Originate.

We source the Capital.

The only lender in the market offering 100% advance rates.

Get paid 1 day after buyer confirmation.

The only lender in the market matching rates offered by other non-banks.

The only lender unrestricted by credit insurance approvals.

100% digital process. Log-in and manage your funding requests

dedicated, personal support

Our Team.

Decades of expertise in trade finance.

Tobias Pfuetze

Co-Founder

Bruno Botelho

Co-Founder